The festive season has well and truly arrived. The Christmas ads are on TV, and sales are in full swing. At this time of year the average household spends around £800 on Christmas, covering the traditional must-haves and trimmings. This can easily push consumers to wake up with a mammoth personal finance hangover on January 1st.

In partnership with WonderBill – a household bill management app – Sarah Willingham shares her top tips on how to avoid getting caught in the red this festive season, and how to start 2019 in good personal finance health.

· Frugal festive fun – It’s easy to get caught up in the festivities, and of course you should enjoy the celebrations but thinking savvy can reduce that New Year finance hangover. For that Christmas party outfit, pick an item you could wear several times in the next year, so it doesn’t just go to the back of your wardrobe. Thinking about festive food? Well this is the time for deals. Whether that’s money off vouchers from supermarket loyalty cards, or taking advantage of bigger order offers online – try and work out what food you need in advance and stick to it. And remember your freezer is your best friend to avoid wastage – you can even freeze milk!

· Bigger and better – It’s inevitable, the dishwasher might need replacing, the fridge goes on the blink or your car breaks down at the worst time. We’ve all been there. Taking time now to put together a contingency plan will pay dividends in those situations. So if you know you may need to upgrade your car in the next year, or you have a holiday that needs to be paid off, then put it in your 2019 budget now.

· Plan,or plan to fail – It sounds SO boring and it’s hard to do, but some kind of budget on a monthly basis can really help to understand what you can and can’t spend outside of the essentials. The Universal Credit changes coming into play in 2019 are going to be tough for some families, plus there’s the general fluctuations of household bills throughout the year – winter always costs that little bit more due to heating bills. Assuming you will be spending the same each month can be a financial recipe for disaster. Look back at your spending for this year, then calculate what you might spend each month in 2019 and budget accordingly.

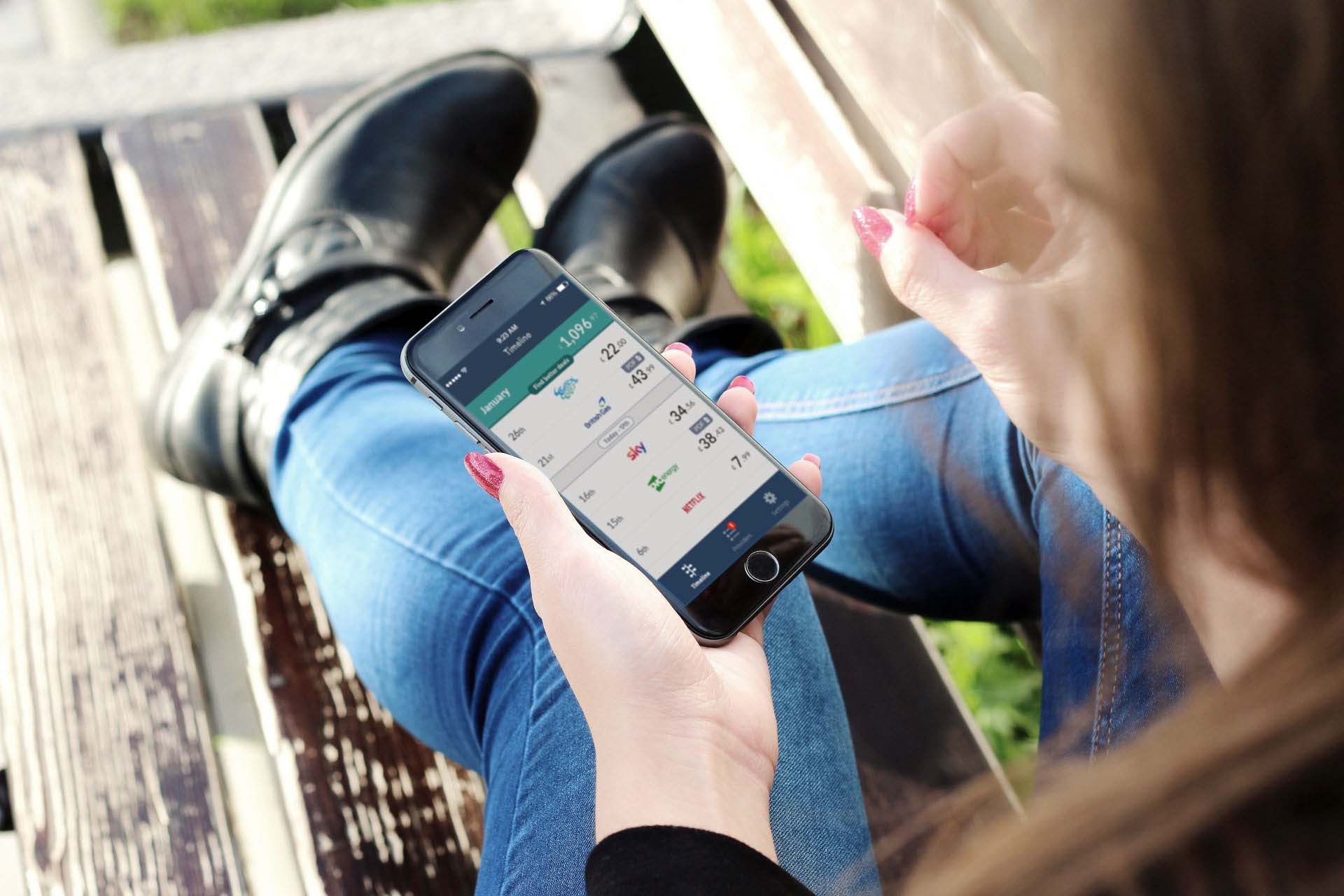

· Get subscription savvy – We live in a subscription-based world with an abundance of providers to pick from. Often, retailers will offer affiliate deals alongside subscriptions as they are keen to keep us hooked to their services. Make sure you are signed-up for emails to ensure you receive all the affiliate deals and take advantage; sometimes it’s possible to consolidate two or three services through one provider, which saves money.

· Switchit up– This is where the quick wins are! ALWAYS check your household bills a tthe start of the year and see where you can save money by switching. This can be significant. As the majority of household bills are taken via direct debit, it’s easy to forget what the actual usage is, and whether you are maximising your subscription, contract and allowance. Utilising apps that help you organise this, by showing usage each month and offering switch deals base don your usage, is certainly the easier route to take as it significantlyr educes the life admin!